The Electronic Payments Coalition released a new report examining how American consumers, including lower-income consumers, utilize reward credit cards and how proposals restricting card issuers’ ability to offer reward credit cards would adversely impact cardholders of all incomes. The study found the share of credit cards offering rewards is nearly identical across income and cardholders, regardless of income, earn rewards at virtually equal rates.

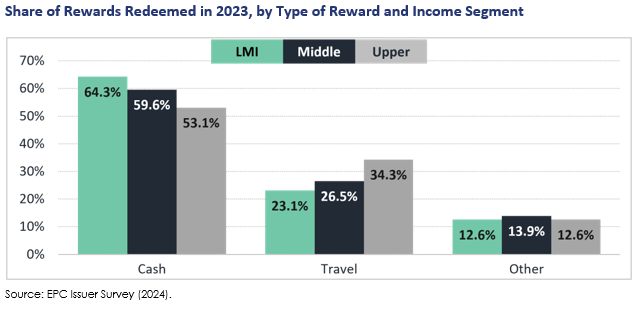

The main difference in rewards usage across incomes was in how rewards are redeemed. While all accountholders prefer “cashback” rewards, Low- to moderate-income (LMI) accounts have a stronger preference for cash, with spikes in November and December as well as during late summer and back-to-school shopping season. Expressed as a share of income, the boost represented through rewards is three to four times larger for LMI cardholders than for the highest income cardholders. For context, rewards earned by LMI cardholders amounts to a 17 cent per gallon annual discount at the gas pump – a tangible savings for these households.

“Americans of all incomes take advantage of credit card reward programs but the most financially vulnerable households depend on cashback rewards to help make ends meet,” EPC Executive Chairman Richard Hunt said. “Saying credit card reward programs only help the rich or are just about getting lounge access at the airport is nothing more than willingly ignoring the full picture. Hardworking Americans rely on their rewards to help make ends meet and manage their daily finances. For many, these credit card rewards served as a lifeline during the record inflation of the last few years.”

The study also found rewards earned from using credit cards can help offset price increases, but cash and debit card users do not benefit from rewards and thus lose out on potential savings generated through cashback rewards. Some have argued merchants simply pass through the cost of card acceptance to all consumers, but the report cites the benefits of credit card acceptance, which can lead to an uptick in purchases that ultimately results in a 5-6.4% net benefit to merchants, even after factoring in acceptance cost. While the increased profitability generated by accepting credit cards means that there is little business rationale to raise prices, for retailers who nonetheless choose to impose surcharges on credit card users to recoup card acceptance costs, the so-called Reverse Robin Hood effort still fails to hold up because the cardholder alone bears the additional cost. Moreover, as the experience of the Durbin amendment demonstrates and myriad research studies have proven, large retailers have failed to pass through savings from debit card interchange reductions to their customers by lowering prices.

Finally, reward cardholders often carry a balance of unredeemed rewards. This represents an important safety net for these cardholders.

The EPC study was conducted during the first quarter of 2024 among EPC members and represents more than half of the credit card market as measured by purchase volume. The study excluded cobranded, small business and international rewards cards. Income segments were approximated using the Community Reinvestment Act income bands.

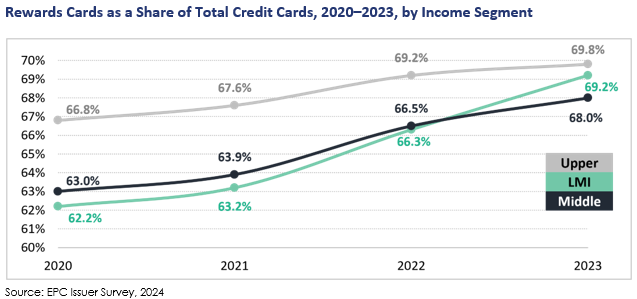

Credit cards owned by lower-income consumers are increasingly likely to offer rewards. As shown in the chart above, over the last four years, rewards card ownership has risen across all income segments, but the share of cards that offer rewards has increased the most for LMI accounts, rising seven percentage points from 62.2% to nearly 69.2% (more than double the percentage point increase for upper-income accounts). The share of credit cards that offer rewards is now nearly identical across LMI, middle-income, and upper-income segments.

In addition to having similar access to rewards cards, cardholders across the income spectrum earn rewards at similar rates. As shown in the chart above, LMI, middle-income, and upper-income rewards accounts earn roughly 1.8 cents in rewards per dollar spent.

In addition to similar earn and redemption rates, there is no set “type” of reward for upper-income cardholders compared to middle-income and lower-income cardholders. As shown in the chart above, each group has access to cash rewards, travel rewards, and “other” rewards (e.g., third-party gift cards and purchase credits), and each income segment takes advantage of each type of offering to a roughly similar degree. The main conclusion from EPC’s issuer survey is that with respect to rewards redemption preferences, there are far more similarities across income segments than differences.

A printable version of the EPC study is included below.