As the Merchants Payments Coalition (MPC) continues sharing stats and figures without context, let’s look at this doozy from today. Their latest Tweet shares an article from the industry publication CSP discussing the booming business made possible by credit and debit cards.

The article cited MPC as reporting, “At more than $187 billion, credit and debit card interchange fees reached another new record last year.” Put aside the fact they confuse interchange, which has remained flat at about 1.8% for nearly a decade, with overall processing costs, which average about 2.3%.

Now, let’s break it down… Overall, processing costs average about 2.3%, and if retailers paid $187 billion in processing costs last year, that means credit and debit card payments enabled them to sell $7,957,446,808,510 worth of goods. To put those $8 trillion in sales into perspective, that’s more than $3 trillion LARGER than the GDP of Germany!!

Instead of bemoaning the ability to process safe, secure, hassle-free payments and prevent fraud, maybe MPC should thank the remarkable system that allows their members to grow their businesses and process payments within seconds worldwide, 24 hours a day, seven days a week.

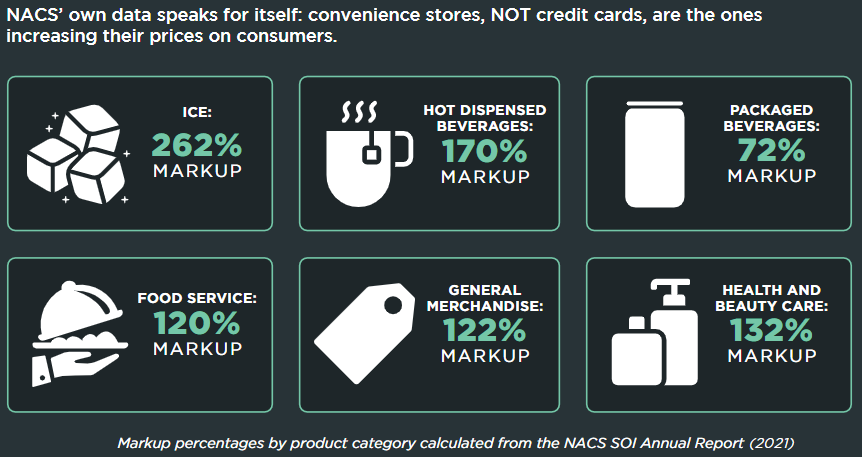

In this same article, an MPC Executive Committee Member and Vice President of Government Relations for FMI, The Food Industry Association, tried to blame credit card processing costs for taking money from consumers and contributing to higher prices. Could supporters of the flawed Durbin-Marshall credit card mandates be putting up such a fuss because they are trying to shift the blame for their own bad actions?