How Electronic Payments Are Helping Make Thanksgiving Dinner More Affordable

The Electronic Payments Coalition (EPC) shares new research today, demonstrating the value of electronic payments for small businesses and consumers this Thanksgiving.

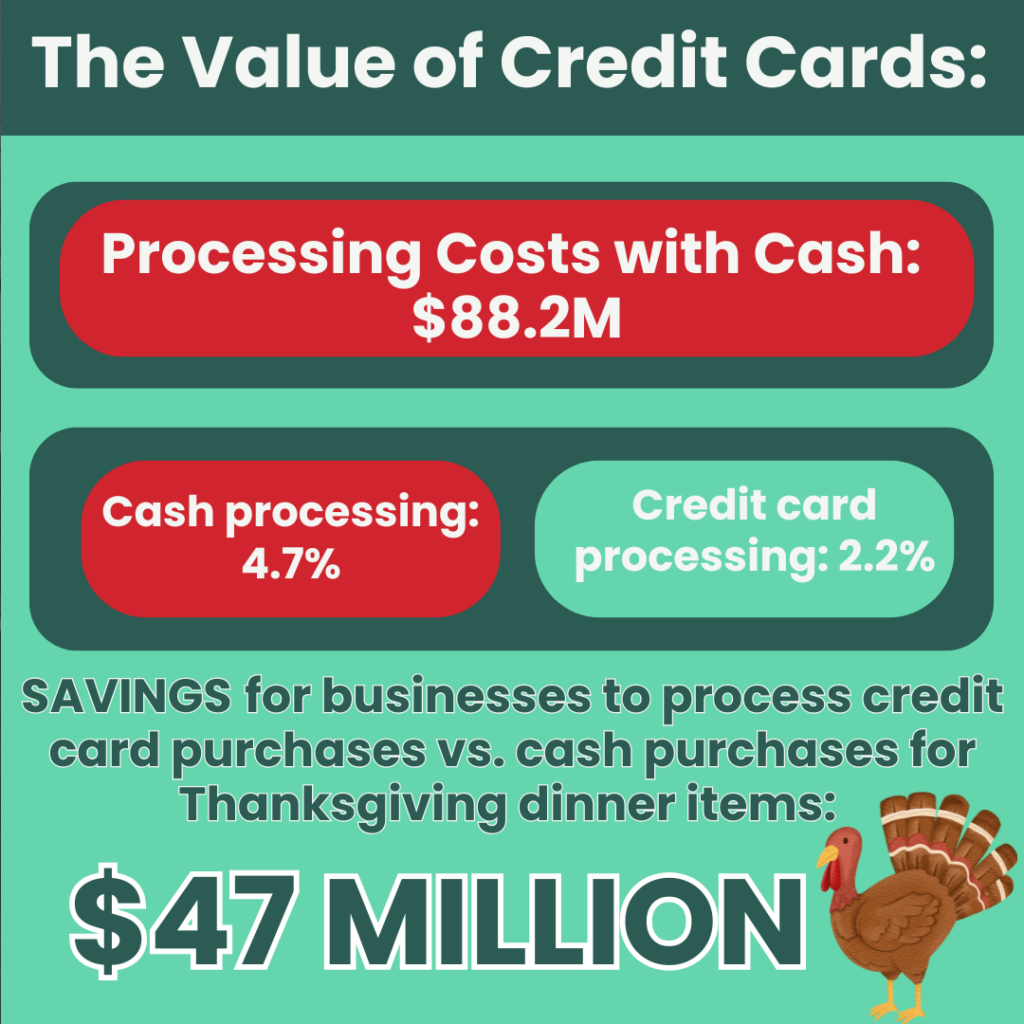

According to the findings, if every household in America used credit cards to purchase their Thanksgiving dinner supplies, grocery stores would save nearly $47 million in processing costs compared to cash transactions.

“As families and friends prepare to gather around the table, credit cards are making holiday shopping more convenient and secure and Americans’ Thanksgiving turkeys more affordable,” said EPC Executive Chairman Richard Hunt. “Without electronic payments, the hidden costs of cash would leave small businesses with higher operating costs, ultimately leading to higher prices for consumers.”

The average Thanksgiving dinner for ten costs $61.17, with U.S. households expected to spend nearly $2 billion on Thanksgiving meals this year. Research from IHL Group reveals that grocery stores pay 4.7% to process cash transactions. Handling cash is not only labor-intensive but also requires significant costly security measures to ensure cash is securely kept and deposited. Beyond additional security investments, businesses also bear expenses for handling cash, including the labor costs to count and deposit money. The National Association of Convenience Stores (NACS) estimates that convenience store staff spend up to 20 paid labor hours a week just counting money. Credit cards help businesses reduce operational costs, a critical advantage as inflation has driven a 25% increase in the cost of Thanksgiving dinners over the last five years.

Despite claims by corporate mega-retailers blaming credit cards for higher costs, the data suggests otherwise as these rates have remained virtually stable around 2% since 2019. In reality, electronic payments help businesses sell more products, streamline operations, enhance consumer data protection, and lower their costs, ultimately benefiting both businesses and consumers.

“The power of credit cards is a huge benefit for small businesses, especially during the holidays,” added Hunt. “When you use your credit card to buy Thanksgiving dinner, you’re not just saving time—you’re helping your local grocery store thrive in a competitive environment. This isn’t just good for businesses; it keeps prices manageable for everyone in the long run.”