Setting the Record Straight on Senate Judiciary’s Bias, Flawed Credit Card Hearing

WASHINGTON, DC — The Senate Judiciary Committee just wrapped up a hearing with a litany of erroneous claims and outright misconceptions spread by supporters of the Durbin-Marshall Credit Card Bill.

“This hearing was so blatantly biased and one-sided, it practically needed a disclaimer saying it was bought, paid for, and sponsored by the campaign donations of the nation’s largest corporate mega-stores,” said Electronic Payments Coalition Executive Chairman Richard Hunt. “Credit and debit cards fueled more than $90 trillion in economic activity since 2006 and are vital to not only our economy but also to businesses and consumers because they facilitate secure, safe, convenient, and timely payments.

“This hearing ignored the small businesses who oppose new mandates on our payment systems; the independent reports showing the Durbin-Marshall bill would be a windfall for corporate mega-stores without any guarantees of lower prices; and in a display of arrogance blocked community banks and credit unions from explaining how these new mandates would make it harder for them to serve their local communities.

“If Senators Durbin and Marshall were serious about protecting consumers and small businesses, they would ask corporate mega-stores to answer for their failure to pass savings along to consumers when Congress passed price-fixing legislation on debit cards in 2010.”

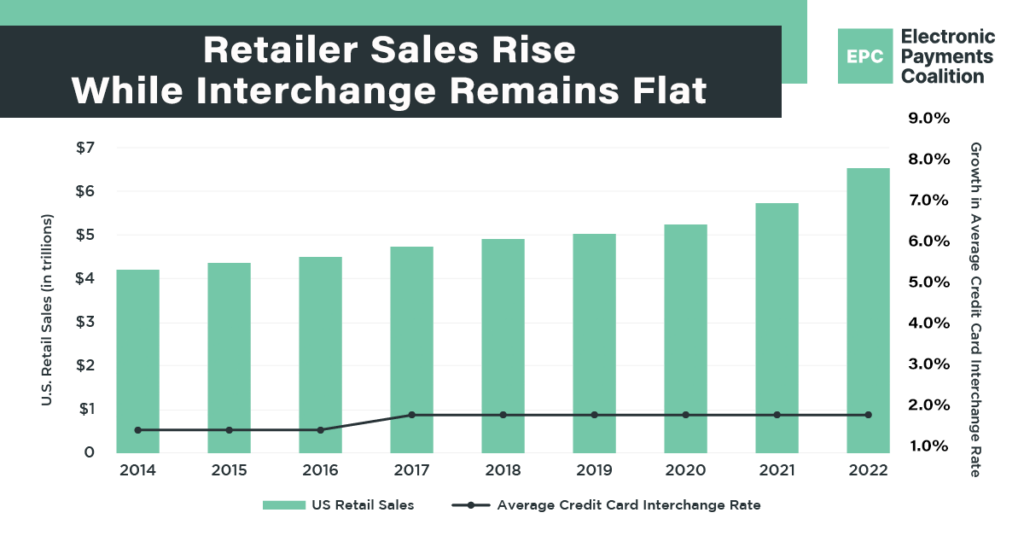

Credit Card Service Costs Remain Flat, Drive Economic Growth

The amount businesses pay for credit card services has remained virtually flat for nearly a decade. The only reason a business or retailer would pay more for processing services is because the business had a proportionately equal increase in sales.

Since 2006, credit card transactions have driven more than $90 trillion in transactions for businesses. In a recent legal filing, the Office of the Comptroller of the Currency wrote, “Credit and debit card transactions help to propel the Nation’s economy by facilitating commerce.”

Savings Will Not and Have Not Been Passed to Consumers

The Congressional Research Service issued a report on the Durbin-Marshall Credit Card Bill and found the bill was unlikely to lower prices for consumers or help small businesses. The Richmond Federal Reserve reported 98% of retailers actually raised prices or kept them the same following the original Durbin amendment, which capped prices on debit cards. Home Depot’s then Chief Financial Officer Carole Tome said on an earnings call in 2011 the company could gain $35 million in revenue annually from the price caps. Those same caps, according to a separate Congressional Research Service found businesses had pocketed more than $140 billion since those caps were enacted.

Congressional Research Service Report on Durbin-Marshall:

- Businesses “might face higher incidences of fraud if payment security is weakened” by routing consumers’ credit cards over untested networks.

- “It is not clear whether retailers would pass interchange savings on to consumers.”

Corporate Mega-Store Profits Are Driving Consumer Prices

Several of the Senators testifying in favor of these new mandates argued credit card services are driving up costs on consumers. But, earlier this year, an executive with Kroger admitted the grocery conglomerate increased prices on consumers greater than inflation and the Federal Trade Commission issued a report finding “retailer revenues exceeded cost increases and profits remain elevated.” FTC Chair Lina Khan added, “dominate firms used [the COVID pandemic] to come out ahead at the expense of their competitors and the communities they serve.”

Additionally, a recently released study by Indraneel Chakraborty, finance department chair at the University of Miami Herbert Business School, found any savings derived from the proposed government mandates in the Durbin-Marshall Credit Card Bill would disproportionately benefit the top five businesses in the U.S., “putting small retailers at a further competitive disadvantage.” The study also found virtually no savings would be seen by retailers with less than $500 million in sales and true small businesses would see a negative $1 billion impact.

Cardholders in Europe Pay Higher Fees

Supporters of the bill also pointed to European rates for credit card services. In Europe, where the central bank has capped interchange rates, cardholders pay on average 13% more and 105% more in France, a country frequently cited during today’s hearing. In the US., fees represent just 5% of revenue while that percentage is three to six times higher in the EU.

In Europe, consumers pay more, receive less in rewards and have fewer options. A tale of two consumer outcomes:

• Less Access: More than 80% of U.S. adults use and have access to credit through credit cards. In continental Europe, those figures hover below 50%, and are as low as 18% in parts of Eastern Europe. And a majority of those credit products in Europe are merely “deferred debit” charge cards.

• Fewer Options: Following new government mandates, the number of credit card options decreased by 14% between 2014 and 2018.

• Higher Fees: The average annual fee on consumer credit cards went up 13% after government caps were imposed. Cardholders pay fees 17% higher in Italy, 76% higher in Germany and 105% higher in France than U.S. cardholders. In the U.S., fees represent just 5% of revenue, while that percentage is three to six times higher in the EU.

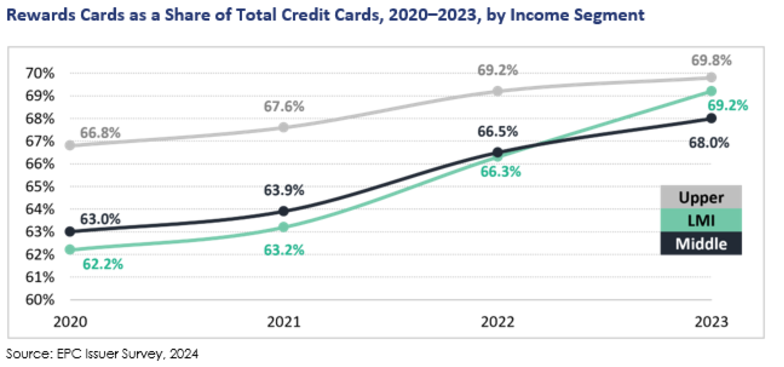

Reward Programs Benefit Americans of All Incomes

Finally, reward programs benefit Americans of all incomes. A recent study from EPC found Americans of all incomes, including low to moderate-income cardholders, earn and redeem rewards at similar levels. Expressed as a share of income, the financial boost for LMI cardholders is three to four times larger than for the highest income cardholders. For context, earned rewards represent a 17 cent per gallon annual discount at the gas pump – a tangible savings for these households.