The Merchants Payments Coalition (MPC) continues to ignore the facts as part of its endless campaign to mislead Congress into passing the Durbin-Marshall Credit Card Bill which primarily benefits the largest corporate mega-stores.

This time, MPC is making up claims about interchange that even they admit are “difficult to calculate.” In a recent Twitter post, MPC is trying to convince lawmakers credit cards are making back-to-school supplies more expensive.

But, here are the facts MPC doesn’t want you to know…

1.) Credit Card Rewards are a Lifeline for Working-class Americans:

- A recent study shows that low- to moderate-income (LMI) cardholders receive a boost to income from their rewards. LMI accounts are most likely to redeem rewards for cash with spikes around the holidays and back-to-school shopping months of August and September, showing these cashback rewards actually help offset everyday expenses.

2.) Accepting Credit Cards Helps Small Businesses:

- The National Federation of Independent Businesses (NFIB) previously outlined all of the the ways accepting credit cards helps small businesses and highlighted the top benefits noting “credit card processing is competitive” and “the increase in sales” will ” typically more than make up” for the cost of card processing, dispelling the misguided notion these costs are driving up prices.

3.) Accepting Cash is More Expensive for Small Businesses Compared to Accepting Credit Cards:

- The Small Business and Entrepreneurship Council (SBE Council) recently published a breakdown showing the value credit card acceptance offers businesses in terms of “security, efficiency, and cost-savings.”

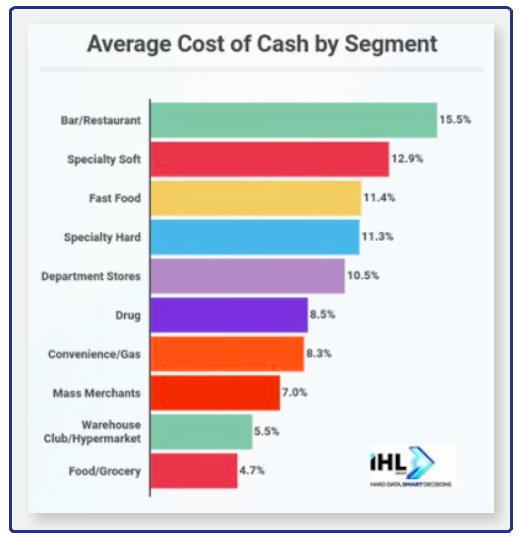

- The IHL Group, a global research and advisory firm for the retail and hospitality industry, issued a report that found the cost associated with handling cash payments can run from 4.7% to more than 15.5% depending on business type, a range significantly higher than the cost of card acceptance.

To paraphrase Shakespeare, MPC doth protest too much.

Perhaps it is because the headlines paint a far different picture about the real driver of consumer price increases.