The National Retail Federation (NRF) was in D.C. this week talking to Members of Congress and staff about the Durbin-Marshall Credit Card Bill. This legislation would place new mandates on how Americans’ credit cards are processed – forcing them to run on untested networks and jeopardizing fraud protection as well as reward programs used by small business owners to reinvest in their businesses and LMI families for back-to-school supplies.

The NRF lobbyists likely said these mandates would “help small businesses” but away from the Capitol, small businesses did not seem to be at the forefront.

Just look at this sign from their summit backers: Corporate mega-stores like Target, Walmart and Amazon. Hardly the small businesses NRF claimed they were out to help. But, it shouldn’t come as a surprise when you look at the facts.

Study after study has reported consumers and small businesses would see little to no benefits from the proposed Durbin-Marshall mandates, but the largest corporate mega-stores stand to pocket billions.

The Richmond Fed found 98% of businesses raised prices or kept them the same when mandates were placed on debit interchange. The Congressional Research Service questioned whether consumers or small businesses would benefit at all. And, the University of Miami found the mandates would put small businesses at a greater competitive disadvantage against corporate mega-stores.

In fact, when Visa and Mastercard reached a historic $30 billion settlement with merchants –90% of which were small businesses – the NRF and Walmart objected. Walmart even went as far as to say small businesses “traded away the interests of large national merchants for relief that is worthless to the members with the most at stake in this litigation.”

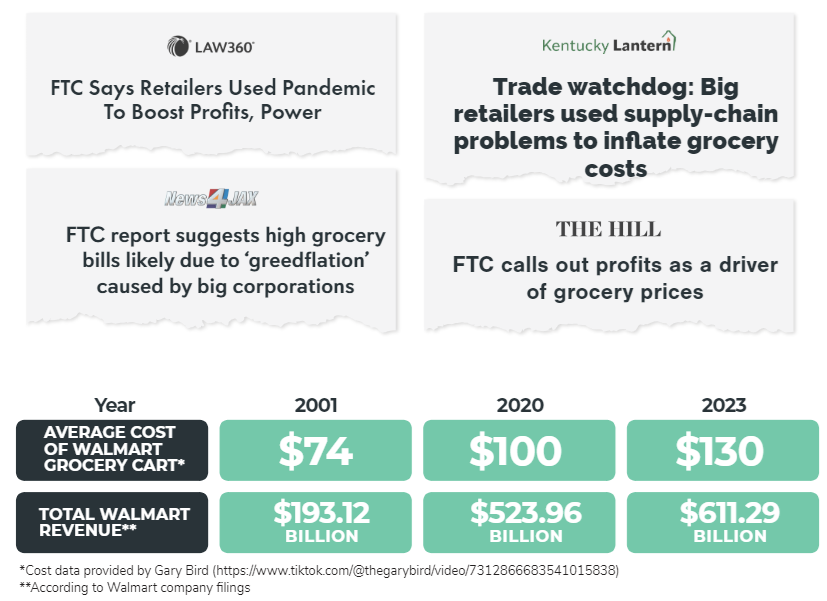

Consumers, too, have been hurt by these corporate mega-stores. A recent Federal Trade Commission report singled out Walmart and Amazon (backers of both the NRF event and the Durbin-Marshall bill) for using “their market power to avoid supply disruptions during the COVID-19 pandemic and that grocery prices remain high because companies used rising costs as an opportunity to boost profits … raising questions about the need for the price increases in the first place.”

So, when you look at all the facts, it becomes pretty clear who really benefits the most from these proposed mandates on Americans’ credit cards. It isn’t consumers or small businesses but rather the largest corporate mega-stores.