Back

CRS Report: “Unclear” Who Durbin-Marshall Credit Card Bill Benefits

| Electronic Payments Coalition

Media Contact:

Nick Simpson

Nick@electronicpaymentscoalition.org

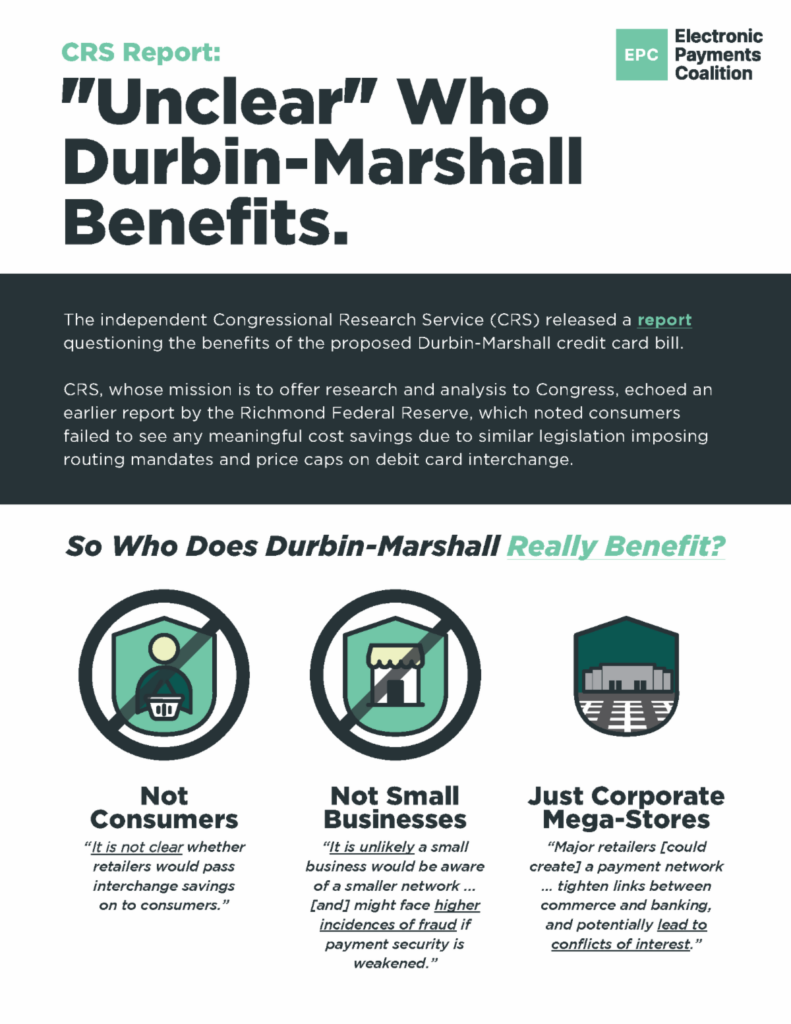

Washington, DC— The Congressional Research Service (CRS) released a report questioning whether small businesses or consumers would see any benefit from the new government mandates in the Durbin-Marshall Credit Card Bill. Numerous reports have noted that when Congress imposed similar mandates on debit cards a decade ago, consumers did not see lower prices as a result.

EPC’s one-pager, copied below, highlights how the CRS was unable to find enough evidence to support the claims being made by supporters of the Durbin-Marshall Credit Card Bill, including:

- Unlikely Benefits for Small Businesses: “It is unlikely a small business would be aware of a smaller network, and even if it did offer payment on that network, the odds that a bank would issue a card enabled for that exact network are relatively small.”

- Questionable Benefits for Consumers: “It is not clear whether retailers would pass interchange savings on to consumers.”

- Increased Fraud: Businesses “might face higher incidences of fraud if payment security is weakened.”

- Security Impacts: “If cards are effectively required to be interoperable, networks may be less willing to invest as much in secure payment technologies, as part of the benefit would accrue to their competitors.”

- Potential for Corporate Mega-Stores to Mix Commerce and Banking: “There may be unintended consequences of this bill. For instance, there is nothing stopping the major retailers from creating a payment network … this would tighten links between commerce and banking and potentially lead to conflicts of interest.”

The full report is available HERE.

More Updates

Is it time for a Truth in Dining Act?

Electronic Payments Coalition

Read

CRS: “Unclear Who Would Benefit” from Durbin-Marshall Credit Card Bill

Electronic Payments Coalition

Read

Press Releases / Statements

EPC on Merchant, Payment Network Lawsuit Agreement

Electronic Payments Coalition

Read

Press Releases / Statements