The NFIB might have changed their tune over the last several years but credit card interchange has not … The last thing Congress should do is threaten the security of our nation’s credit card payment systems just so retailers like Walmart and Target can make more money at the expense of consumers and small businesses on Main Street.

EPC Executive Chairman Richard Hunt

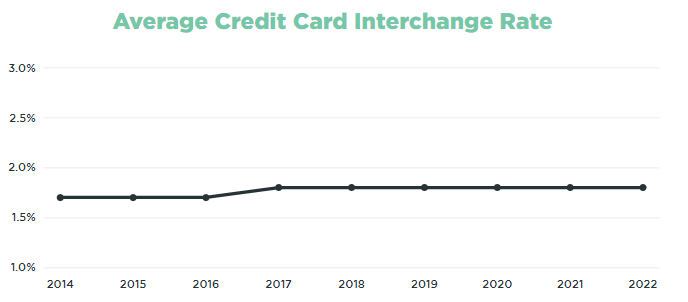

WASHINGTON, D.C. — Over the last decade interchange rates have essentially flatlined around 1.8% and have not changed since 2017. The nation’s largest retailers, led by mega-stores like Walmart and Target, are now trying to change that narrative and convince Congress to impose new government mandates on America’s payment systems to line their pockets.

“Interchange rates have remained largely unchanged over the past decade but now the nation’s largest retailers are trying to pull a fast one and rewrite history. In fact, interchange rates have not increased a fraction of a percent since 2017, when the National Federation of Independent Businesses said ‘accepting credit cards has numerous benefits for your business’ and that ‘a merchant account is relatively inexpensive, considering what it delivers.’

“The NFIB might have changed their tune over the last several years but credit card interchange has not. Like the saying goes, the more things change, the more they stay the same.

“It is time Durbin-Marshall CCCA supporters come clean about who is really championing this legislation and why. The last thing Congress should do is threaten the security of our nation’s credit card payment systems just so retailers like Walmart and Target can make more money at the expense of consumers and small businesses on Main Street.”

— Electronic Payments Coalition Executive Chairman Richard Hunt

The top 10 benefits of accepting credit cards, as outlined by NFIB, are available here and an excerpt from that list is below citing the competitiveness and affordability of the credit card industry. The average credit card interchange rate by year is also copied below.