New Data Reveals Credit Interchange and Merchant Discount Rates Have Remained Stable for The Past Seven Years

WASHINGTON, DC – Today, the Electronic Payments Coalition (EPC) released its 2023 Q1 Data Dashboard highlighting the emerging trends within the credit and debit markets.

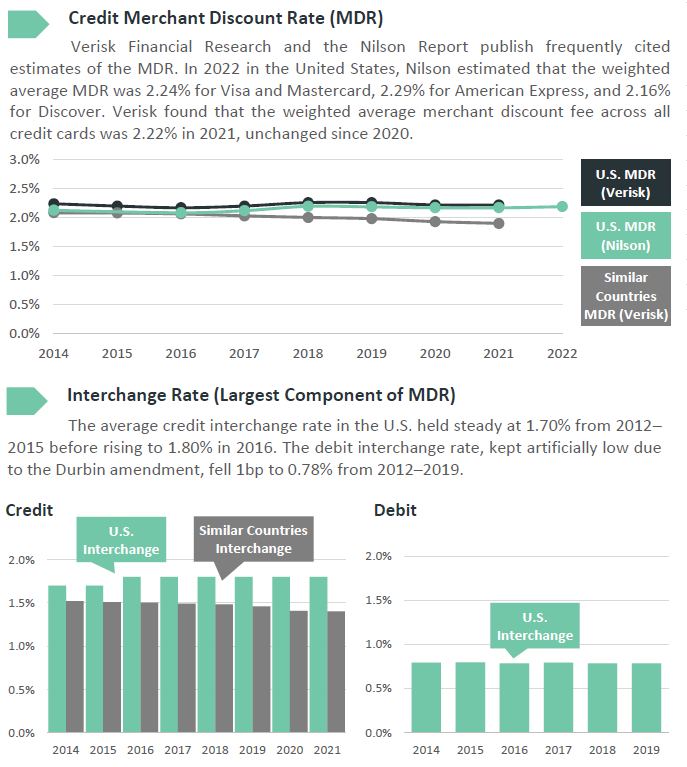

Newly released data featured in the Q1 Data Dashboard show that as a share of purchase volume, credit interchange and merchant discount rates have remained stable for the past seven years. In 2022, the weighted average merchant discount rate for credit cards was 2.19%.

Additionally, the Data Dashboard highlights how card issuers and networks are increasing investments in payment innovation. These innovations include new BNPL plans, tightened payment security, and further integration of digital wallets. Consumer reliance on payment cards continues to grow across all ages and demographic groups. In 2021, card-based spending comprised 75.6% of consumer payment transactions, and current trends indicate it could grow to 80.4% in the next five years.

While consumer reliance on electronic payments is up across the board, various generations value credit card benefits differently. Baby boomers prioritize costs, such as interest rates and fees, while more Gen Z cardholders emphasize rewards and online digital wallet use. In fact, 51.1% of Gen Z consumers are most likely to view digital wallets as a potential complete replacement for physical wallets. This indicates that cashless transactions are likely to grow in popularity and require merchants’ further adoption of cashless payment networks.

“Consumers across all generations heavily rely on electronic payments and the benefits they provide, such as rewards programs, convenience, and fraud protection,” said Jeff Tassey, Chairman of the Board of EPC. “The data speaks for itself, interchange and merchant discount rates have remained stable for the past seven years, while retail sales volume continues to skyrocket. Both consumers and retailers greatly benefit from the value of electronic payments. Lawmakers should continue to reject harmful attempts to unnecessarily regulate interchange which would undermine America’s thriving and competitive electronic payments industry.”

To view EPC’S Q1 Data Dashboard, click HERE.

###

The Electronic Payments Coalition represents the credit unions, community banks, payment card networks, and institutions who support the backbone of our economic system: electronic payments.