EPC Statement & Fact-Check Following Durbin-Marshall Press Conference

Legislation helps mega-retailers, not small businesses; Harms consumer protections and jeopardizes rewards

WASHINGTON, DC — Today, Electronic Payments Coalition Executive Chairman Richard Hunt issued the following statement after Senators Richard Durbin (D-IL), Roger Marshall (R-KS), and Peter Welch (D-VT) held a press conference pushing to attach the Durbin-Marshall credit card routing legislation to military, veterans and agriculture funding bills:

“This legislation will not help small businesses – plain and simple. The smallest businesses on Main Street, the real mom-and-pop shops who keep communities alive, often use third-party payment providers that charge the same for a debit or credit transaction. If the cap on debit interchange Senator Durbin snuck through more than a decade ago did nothing to help these business owners, why will this?

“The real winners, however, are the same big-box retailers like Walmart and Target who pull customers away from Main Street to highway bypasses and strip malls. The Durbin-Marshall bill will be a windfall for them, and it will hurt consumers in the process.

“What the supporters of this bill aren’t telling you is interchange dollars are going back to consumers across all income levels in the form of rewards – cash back for groceries and gas, points for travel and family vacations – or to be reinvested in keeping consumers safe, through protections and security innovations. These international conglomerates want that money, and we know they will pocket it instead of lowering prices, just like they did the first time with Durbin 1.0.

“Let’s call this what it is: a wealth transfer from consumers to big-box retailers.”

Durbin-Marshall Press Conference Fact Check:

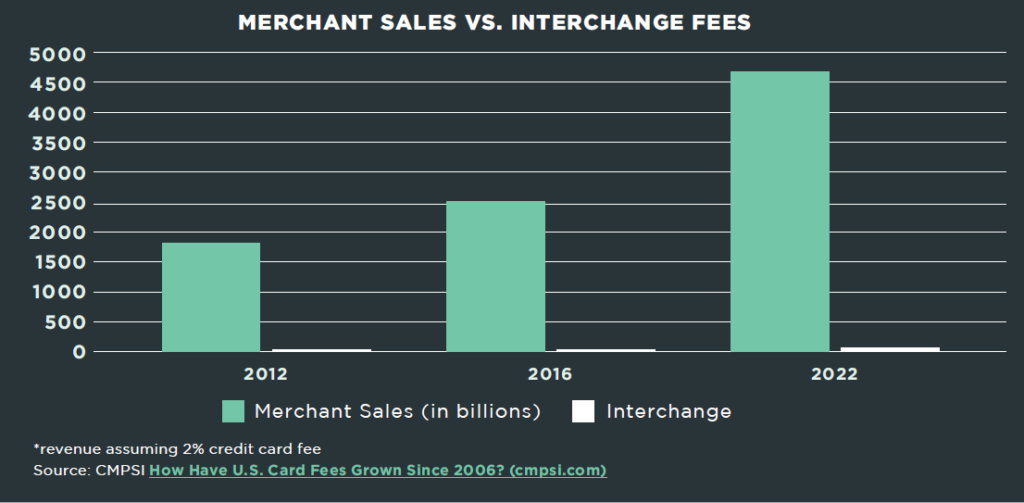

Fact: Credit card costs are NOT skyrocketing.

The narrative that merchant interchange fees continue to increase leaves out the critical fact that it is impossible for “swipe fees” to increase if sales do not increase. The rate of interchange has remained flat for the past seven years, as sales have grown substantially.

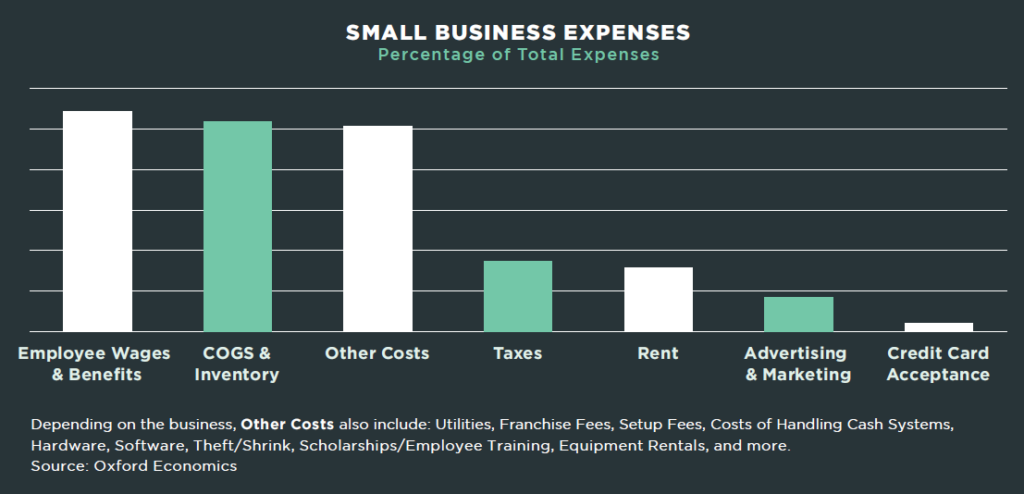

Fact: Credit card processing is not among the highest costs paid by small businesses.

Credit interchange costs for a typical small business is only approximately 1 percent of their total expense. According to a 2020 study by the National Federation of Independent Business (NFIB), the top problems for small businesses (associated with expenses) include cost of health insurance, federal taxes on business income, property taxes, state taxes on business income, cost of supplies/inventories, and cost/availability of liability insurance. In the 2016 version of this study, credit card processing fees ranked as the 38th problem (out of 75) for small businesses. In the 2020 study, credit card fees were not even included as one of the 75 potential business problems.

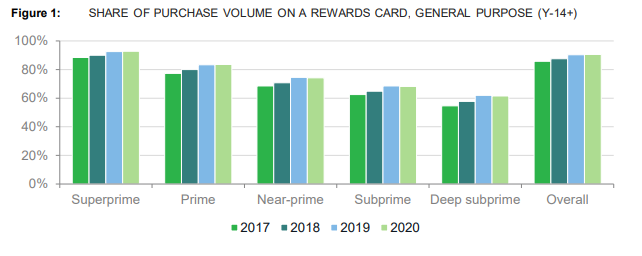

Fact: Americans from all credit brackets use reward cards.

According to the Consumer Financial Protection Bureau’s 2021 report on credit card usage, Americans from all credit brackets utilized reward cards. The CFPB found, “The share of credit card spending accounted for by rewards cards has continued to increase since 2018. That is true both overall and for each credit score tier, with growth particularly notable for consumers with lower credit scores. By the end of 2020, even consumers with deep subprime scores put more than 60 percent of their credit card purchase volume on rewards cards, and consumers with near-prime scores put nearly three-fourths of their spending on rewards cards.”

Source: CFPB