WASHINGTON, DC – The Merchant Payments Coalition tried to take another swing this week at credit cards, blaming them for the challenges D.C. restaurants are facing. While this narrative may help their push for flawed credit card mandates, it’s a miss when it comes to the facts.

A study released by the National Federation of Independent Businesses this past summer highlighting “small business problems and priorities” revealed more small business owners say credit card payment processing costs are “NOT A PROBLEM” compared to those reporting it as a critical one. The very first chart in the NFIB’s report did not even list credit card processing as a top 20 problem for small business owners, falling well below the cost of health care, taxes, utility costs, interest rates, and government paperwork.

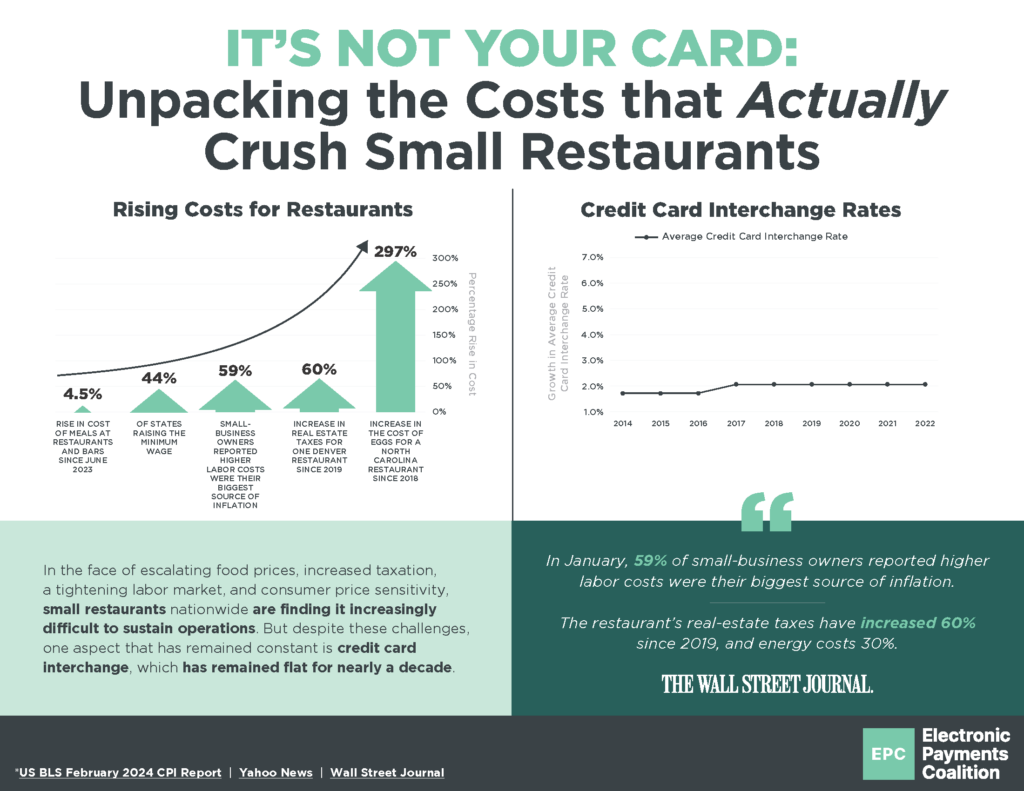

While credit card processing costs have remained virtually flat at just more than 2% over the last decade, it’s worth considering, for restaurants specifically, the actual rising expenses small business owners and local restaurant owners face as virtually everything else increases in costs. Eggs have increased by triple digits. More than four in 10 states have increased minimum wage. Real estate taxes and utilities, too, have increased. According to the Wall Street Journal, nearly 60% of small business owners reported labor costs as their largest source of inflation.

If, according to NFIB data, small business owners are not saying credit card processing is a top concern, then why is the Merchants Payments Coalition so adamant on pushing the narrative? Well, perhaps it has something to do with who really wins if these mandates are passed.

Hint: This Isn’t About Small Businesses. Corporate mega-stores are just using them as the face of their multi-billion-dollar scheme.

The University of Miami reported the mandates would benefit “retailers with $500 million or more in annual sales, with little going to small businesses” and the “largest U.S. retailers would effectively receive a transfer of approximately $2.9 billion” as a result.