Hint… Credit card processing ranks so low it wouldn’t even make the NCAA’s new football playoffs

The Merchants Payments Coalition (MPC) continues to distort the facts as part of its endless campaign to mislead Congress into passing the Durbin-Marshall Credit Card Bill.

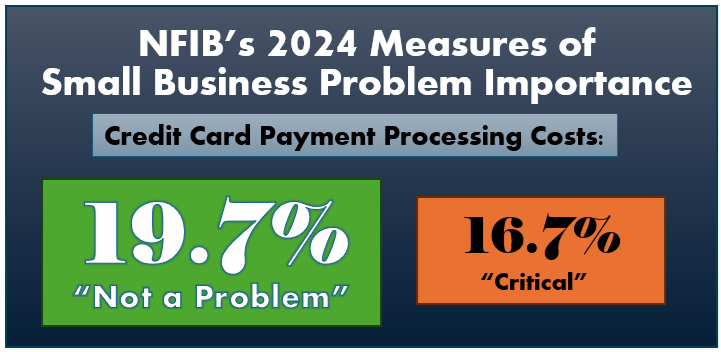

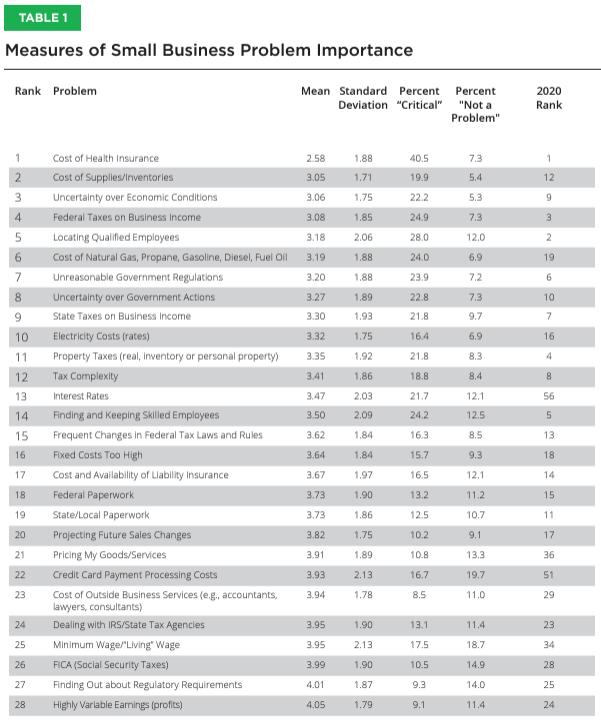

Most recently, MPC promoted the 2024 NFIB survey on “small business problems and priorities” and attempted to claim credit card payment processing as a top concern. In reality, the NFIB’s own survey reports more small business owners say credit card payment processing costs are “NOT A PROBLEM” compared to those reporting it as a critical one.

The first chart in the NFIB’s report even ranks the top problems facing small businesses. Credit card costs barely crack the top 25 problems for small business owners, well below the cost of health care, taxes, utility costs, interest rates, and government paperwork.

If you dig deeper into the NFIB’s own report, small business owners say credit cards help them get paid faster:

Another issue that has declined in importance over the recent years is ‘Delinquent Accounts/Late Payments.’ Since 1982, this problem ranked 16th, 21st, 28th, 40th, 44th, 34th, 45th, 46th, 54th, and 58th in 2020 and 2024. Over the past few decades there has been an increase in financing options and expanded use of credit cards that has eased many payment issues previously faced by small business owners.

2024 NFIB Problems & Priorities Survey