A Message to New Members of the 118th Congress: Electronic Payments Have Never Been More Valuable to America’s Economy

Electronic payments are the cornerstone of America’s economy. They empower consumers, strengthen small businesses, and uphold financial infrastructure. As America’s credit unions, community banks, payment networks, FinTechs, and financial institutions, the Electronic Payments Coalition (EPC) supports the backbone of our economic system—electronic payments—and defends it against threats.

As you enter the 118th United States Congress, here’s what you need to know about electronic payments, and what they mean to the American economy:

The Value of Electronic Payments

The electronic payments system is tremendously valuable to small businesses, financial institutions, and consumers alike. Here’s how:

Electronic payments…

Bolster Consumer Spending:

Consumer spending, which has long been the most important factor in U.S. economic growth, continues to be fueled by the innovation of electronic payments. Even during the COVD-19 outbreak, electronic payments allowed small businesses to pivot to online sales, curbside pick-up, and in-store self-checkout.

Protect Consumers’ Data:

Payment networks have been at the forefront of consumer data security for years. Following the industry-led transition to EMV chip cards in 2015, U.S. counterfeit card fraud fell by nearly half. Additionally, value lost to counterfeit fraud in the U.S. fell by 46% from 2016 to 2021. As consumer shopping habits continue to shift to mobile and online platforms, advancements in tokenization provide seamless and secure transactions without exposing customers’ sensitive account information. These features also protect merchants by making tokenized payment data useless if compromised. Payment networks have been at the forefront of consumer data security for years. Following the industry-led transition to EMV chip cards in 2015, U.S. counterfeit card fraud fell by nearly half.

Save Small Businesses Money:

The electronic payment system is a low-cost value add for the payments ecosystem that is efficient and secure—with card users accounting for 61 percent of total transactions and spending, on average, $42 more per purchase than cash users. Meanwhile, accepting and handling cash is expensive, costing 9.1 percent of revenue on average and reaching upwards of 15 percent. Support Financial Institutions: Not only do financial institutions bear the majority of the risk associated with potential fraud or insufficient funds, but they also incur substantial costs by providing fraud prevention, transaction monitoring, data processing, and customer service and benefits. As a result, institutions of all sizes depend upon interchange revenue from electronic payments. Without that revenue financial institutions like community banks would suffer greatly.

Provide Value to Consumers:

U.S. consumers receive a variety of benefits from using credit cards including: expanded purchasing ability, avoidance of cash expense, credit card rewards such as cash back and travel points, and other card services. The annual benefits for consumer credit cards have been estimated to exceed $445 billion dollars.

What is Interchange?

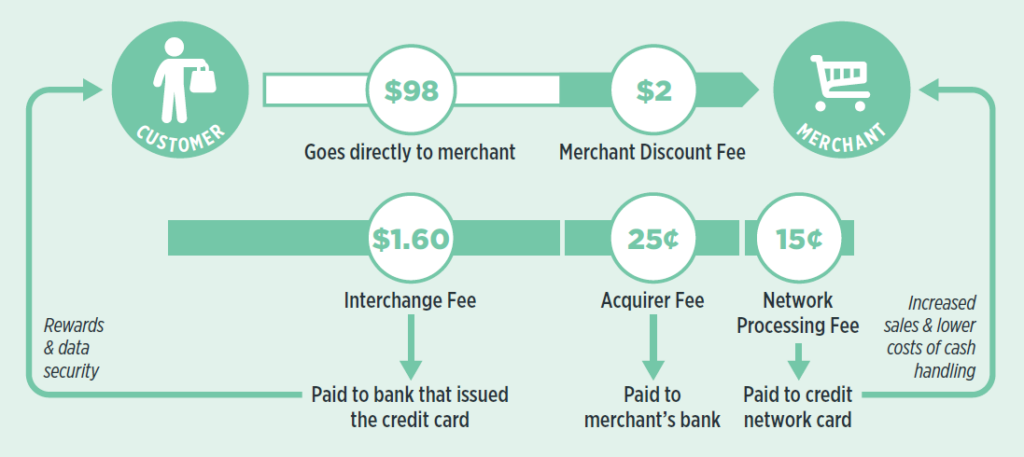

Interchange is an essential part of the electronic payments ecosystem that ensures its functionality. Interchange, on average, is a 2% fee that merchants and retailers pay to accept electronic payments. Payment networks and card issuing banks use interchange to invest back into the payment ecosystem for rewards, card security, innovation, basic credit access and more. Merchants often take a cut of interchange revenue too. Every merchant with their own card program receives interchange revenue. This critical component of electronic payments benefits consumers and merchants alike.

As shown in the figure above, merchants keep about 98% of the revenue from every sale paid by credit card. The remaining 2% is called the merchant discount fee.

DEFINITION: Merchant Discount Fee =

Interchange Fee + Network Fee + Acquirer Fee

Is collected by the acquirer from merchants

DEFINITION: Interchange Fee =

Portion of Revenue from Sale

Is set by networks and paid by acquirers to issuing banks

Current Threats to Electronic Payments

The Credit Card Competition Act/Credit Card Routing Mandates:

On July 27th, 2022, U.S. Senator Dick Durbin (D-IL) and Senator Roger Marshall (R-KS) introduced legislation (S. 4674) that would enact harmful credit card routing mandates. This legislation would allow big-box retailers—like Walmart and Target—to process credit card transactions based solely on what is cheapest for them without regard to the value that consumers derive from rewards and many other benefits. This would add billions of dollars to the bottom lines of mega-retailers every year while eliminating almost all the funding that goes towards popular credit cards rewards programs, weakening cybersecurity protections, and reducing access to credit.

Original Durbin Amendment:

The original Durbin Amendment, passed in 2010, has continuously failed consumers, small businesses, and credit unions for far too long. Big-box retailers and convenience stores promised to pass savings from debit card interchange fee caps on to consumers—then never did. A study found that more than three-fourths of retailers did not change their prices post-Durbin, and many even raised their prices instead of lowering them. As a result, they pocketed more than $106 billion in Durbin Amendment profits since 2011. Additionally, Federal Reserve data clearly shows that interchange revenue fell for community banks and credit unions. Since 2012, issuers have lost nearly $107 billion in interchange revenue—including an estimated $15.2 billion in 2020 alone.

Big-Box Retailers and Merchant Groups:

Merchant and retail groups made some big promises when they proposed debit card interchange regulations in 2010. Turns out, none of those promises were true. Small financial institutions lost billions of dollars in funding, and more than one million Americans lost access to vital banking services. Today, these special interest groups are making the same exact promises about proposed credit card interchange regulations. How does anyone trust them?