A Priority Without a Problem: NFIB once again lists the

Durbin-Marshall Credit Card Mandates as a top legislative priority, despite its own data showing credit card processing costs are not a top concern for small businesses.

This week, the National Federation of Independent Business (NFIB) released its legislative priorities for 2026, again calling on Congress to advance the untested and flawed Durbin-Marshall Credit Card Mandates. NFIB’s continued push comes despite extensive research showing these mandates would not lower prices or meaningfully help small businesses – but would rather weaken their ability to compete with the corporate mega-stores backing this government takeover of Americans’ credit cards.

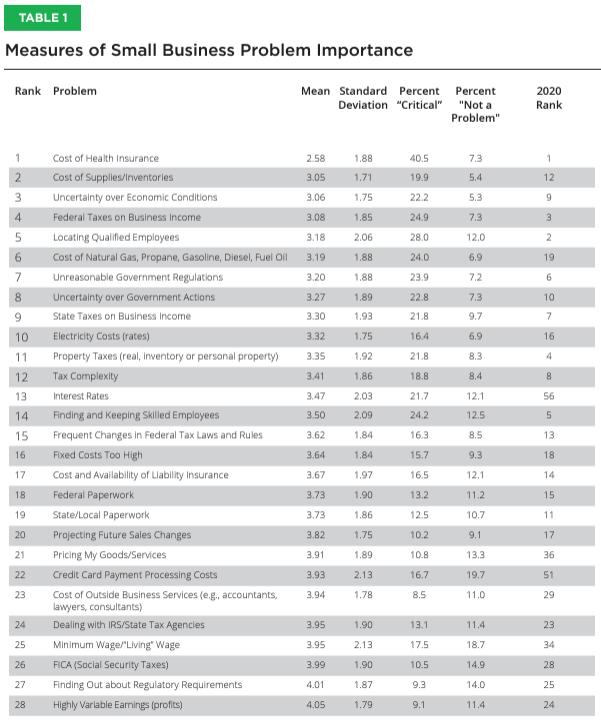

More striking, NFIB’s own survey data undercuts its advocacy. In its most recent Small Business Problems & Priorities report, more small business owners say credit card payment processing costs are “not a problem” than those who identify them as a critical concern—placing the issue well outside the top priorities facing Main Street businesses. In short, NFIB’s Washington agenda does not align with the realities reported by the small businesses it claims to represent.

The most recent ranking of problems by importance shows credit card processing costs does not even crack the top 20 and is well below the cost of health care, taxes, utilities, and government paperwork.

If you dig deeper into the NFIB’s own report, small business owners say credit cards help them get paid faster:

“Another issue that has declined in importance over the recent years is ‘Delinquent Accounts/Late Payments.’ Since 1982, this problem ranked 16th, 21st, 28th, 40th, 44th, 34th, 45th, 46th, 54th, and 58th in 2020 and 2024. Over the past few decades, there has been an increase in financing options and expanded use of credit cards that has eased many payment issues previously faced by small business owners.”

BOTTOM LINE:

NFIB’s own data shows when it comes to their legislative agenda, credit card processing rates are a priority in search of a problem and credit card acceptance offers a significant value to small businesses.