Credit Card Cashback Rewards Vital for Families’ Back-to-School Shopping

LMI cashback redemption surpasses every other income bracket during back-to-school shopping season

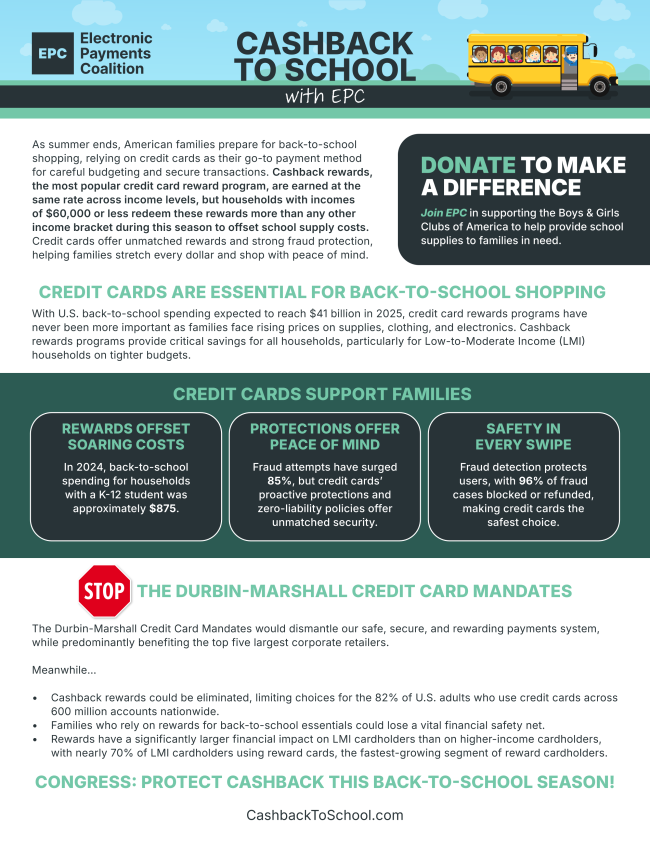

WASHINGTON – As families across the country prepare for the new school year, the Electronic Payments Coalition (EPC) is highlighting the critical role credit card cashback rewards play in helping households manage back-to-school costs.

Cashback reward redemption among households earning less than $60,000 per year surpass every other income bracket during the back-to-school shopping timeframe, according to a recent EPC study. These rewards help families stretch their budgets across essential expenses, especially as corporate mega-stores’ prices continue to climb.

To help support families this season, EPC made a donation to Boys and Girls Clubs of America to provide school supplies to students in need. Learn more about the power of cashback rewards at www.CashBackToSchool.com.

“Credit cards do more than make it easier to pay for school supplies, they actually make them more affordable. Cashback rewards are a lifeline for many families, providing a financial boost when it is needed most,” said EPC Executive Chairman Richard Hunt. “This is not just about points or miles. It is about ensuring students have the supplies they need to start school ready to learn and giving parents peace of mind in the process. Credit card cashback rewards help make that possible.”

Total back-to-school spending in the United States is expected to reach $41 billion, with the average family spending around $850 on supplies for students in elementary through high school. From supplies and clothing to electronics, cashback rewards provide meaningful savings, especially for families managing tight budgets.

Credit cards also offer strong security protections at a time when both spending and fraud are on the rise. Payment fraud attempts have surged 85%, but credit cards safeguard purchases with zero liability fraud protection and robust data security, giving parents confidence that their purchases are safe.

“These protections, along with cashback and other rewards, make credit cards essential tools for families, especially during the costly back-to-school rush,” Hunt added.

Hunt also spoke with television and radio stations across the country during a satellite media tour earlier this week to discuss the benefits cashback rewards offer families and how the Durbin-Marshall Credit Card Mandates would jeopardize reward programs and security features. Some of those interviews are available here and here.

A printable PDF with more information is available here or by clicking the image below.