Promoting Small Businesses: Credit, Debit Cards Generated $12 Trillion in U.S. Economic Activity & Prevent Fraud

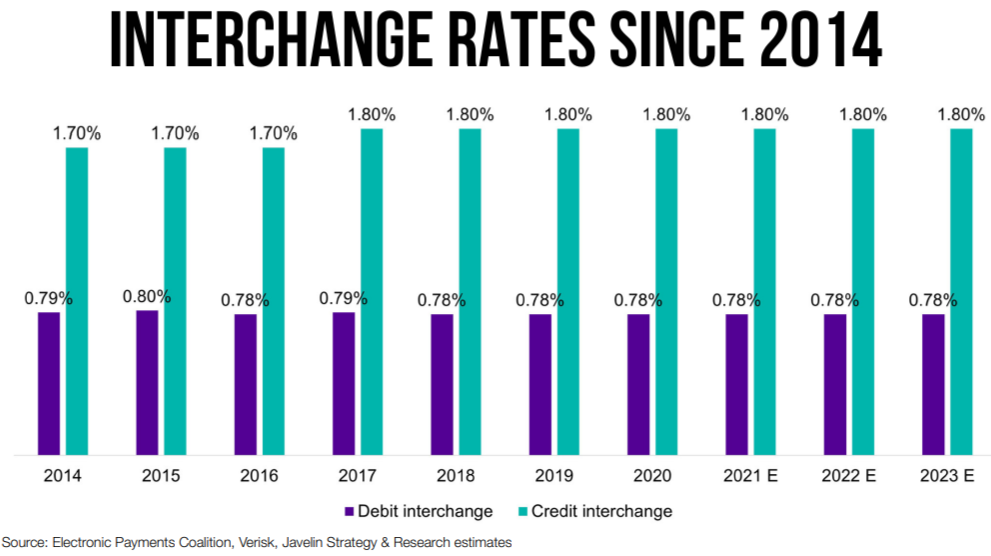

Latest data shows the annual U.S. purchase volume of credit and debit cards has increased from $5 trillion to $12 trillion a year over the past decade while interchange rates have remained stable.

WASHINGTON, DC – Sales through credit and debit card transactions drove nearly $12 trillion in economic activity in 2024, according to new purchase volume data from Nilson. “Credit and debit cards played a vital role in keeping our economy moving in 2024,” said Richard Hunt, Executive Chairman of the Electronic Payments Coalition.

“Consumers and small businesses rely on credit and debit cards for their ease of use, strong security features, and cashback rewards—tools that helped families stretch their budgets amid rising costs. Businesses of all sizes benefit from the speed and reliability of card payments, which ensure they get paid securely and on time. Major payment networks continue to invest billions of dollars to protect consumers and strengthen the global payments system, all while keeping credit card processing costs flat for nearly a decade—offering a far more efficient alternative to handling cash.”

The IHL Group, a retail advisory firm, found accepting and processing cash has a substantial cost of at least 4.7% for businesses and more for some retail segments. Credit card processing, on the other hand, is about 2% and capped for debit cards.

Some politicians and special interest groups are ignoring the facts to push legislation placing new mandates on Americans’ credit cards. The Durbin-Marshall credit card mandates would require credit cards to have the ability to run on secondary, untested networks. This change would lead to increased fraud and security protections while threatening valuable rewards programs.

Supporters of the legislation claim the proposed mandates would lead to lower costs for consumers but the independent Congressional Research Service examined the Durbin-Marshall Credit Card Bill and concluded “it is not clear whether retailers would pass interchange savings on to consumers.” Additionally, the Federal Reserve Bank of Richmond found 98% of retailers either raised prices or kept them the same following government price caps on debit card processing costs.

“It just doesn’t make sense when you look at the facts,” Hunt said. “D.C. politicians and their campaign donors are trying to build a false narrative to pass a law that hurts small businesses and consumers so the largest corporate mega-stores can have another windfall.”