New Study: Credit Card Interchange Flat for a Decade; Consumers Value Credit Card Security

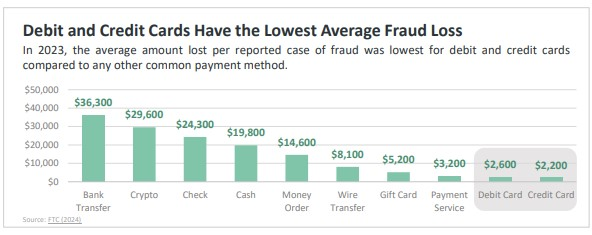

Credit & Debit transactions reported lowest rate of fraud

WASHINGTON, DC — Today, the Electronic Payments Coalition (EPC) released its 2024 Q3 Data Dashboard, which highlights the emerging trends within the credit and debit markets.

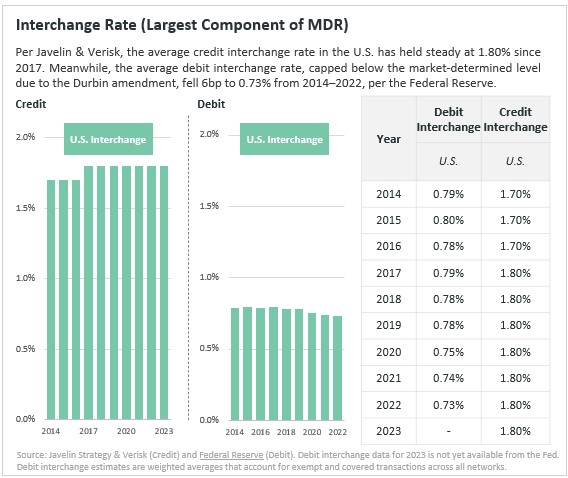

The data shows that interchange rates, a part of the cost retailers pay to process credit cards, have remained flat for nearly a decade at less than 2%, clearly debunking claims of rising processing costs.

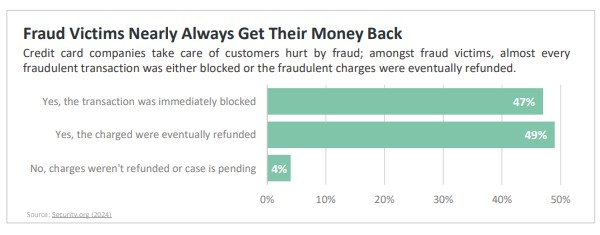

Consumers also ranked transaction safety and security as the most important consideration for why they chose a credit card, with 80% saying it was “highly important.” Debit and Credit Cards also have the lowest rate of fraud among common payment systems, and when fraud was reported, 96% of credit card consumers reported the fraud was either blocked or refunded.

Credit cards are essential, offering consumers not only rewards and flexibility but also unparalleled protection against fraud. As credit card companies continue to enhance security measures, credit cards will remain the preferred and safest payment method for millions of consumers, ensuring both convenience and peace of mind.

To view EPC’S Q3 Data Dashboard, click HERE.

###