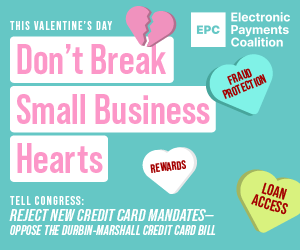

Congress: Reject New Credit Card Mandates

Oppose the Durbin-Marshall Credit Card Bill

CONGRESS: IT’S TIME TO DUMP THE DURBIN-MARSHALL CREDIT CARD BILL: Congress has a toxic relationship with card routing mandates. Despite over a decade of research showing that similar mandates for debit cards were a disaster for consumers, small businesses, and small financial institutions, corporate mega-stores are back and promising this time things will be “different.”

But the truth is that the Durbin-Marshall Credit Card Bill is a sweetheart giveaway to mega-corporations like Walmart and Target, while eliminating credit card rewards, weakening fraud protections, and reducing access to credit for low-income Americans. Congress: This Valentine’s Day, it’s time to break up with the Durbin-Marshall Credit Card Bill and protect the value and security of America’s payments system.

New Study: Durbin-Marshall Credit Card Bill a Win for Nation’s Top 5 Retailers, Loss for America’s Small Businesses

A recently released report by Indraneel Chakraborty, finance department chair at the University of Miami Herbert Business School, found any savings derived from the proposed government mandates in the Durbin-Marshall Credit Card Bill would disproportionately benefit the top five businesses in the US, “putting small retailers at a further competitive disadvantage.” The study also found virtually no savings would be seen by retailers with less than $500 million in sales and true small businesses would see a negative $1 billion impact.

A copy of the report is available here .

Key findings in the report, Imposing Alternative Payment Networks on Credit Cards Will Likely Hurt Low Income Households and Small Merchants , are below:

- Top 100 retailers could see a benefit of nearly $3 billion with $1.2 billion going to just the top 5 largest retailers.

- “The largest US retailers would effectively receive a transfer of approximately $2.9 billion from issuers and cardholders impacted by the legislation. But small businesses would save significantly less, if anything, putting small retailers at a further competitive disadvantage than is currently the case.”

- Small businesses generate roughly $12 billion or roughly one-tenth of all credit card rewards, which are often reinvested in their businesses to cover operational expenses and provide employee benefits.

- Following similar mandates on debit cards, “retailers with mostly smaller transactions [saw] an increase in card acceptance costs” while “large merchants experienced a 22 basis point drop in fees, but that there was no reduction in fees for medium and smaller merchants. ”